Removing friction to allow acceleration.

Removing friction to allow acceleration.

Fifty years ago XX% of the top NN tech companies in the world were European. Now it’s one. All of the new entrants from the US were once startups. And the one sole European company is a spin-out of a large established company.

What's happening?

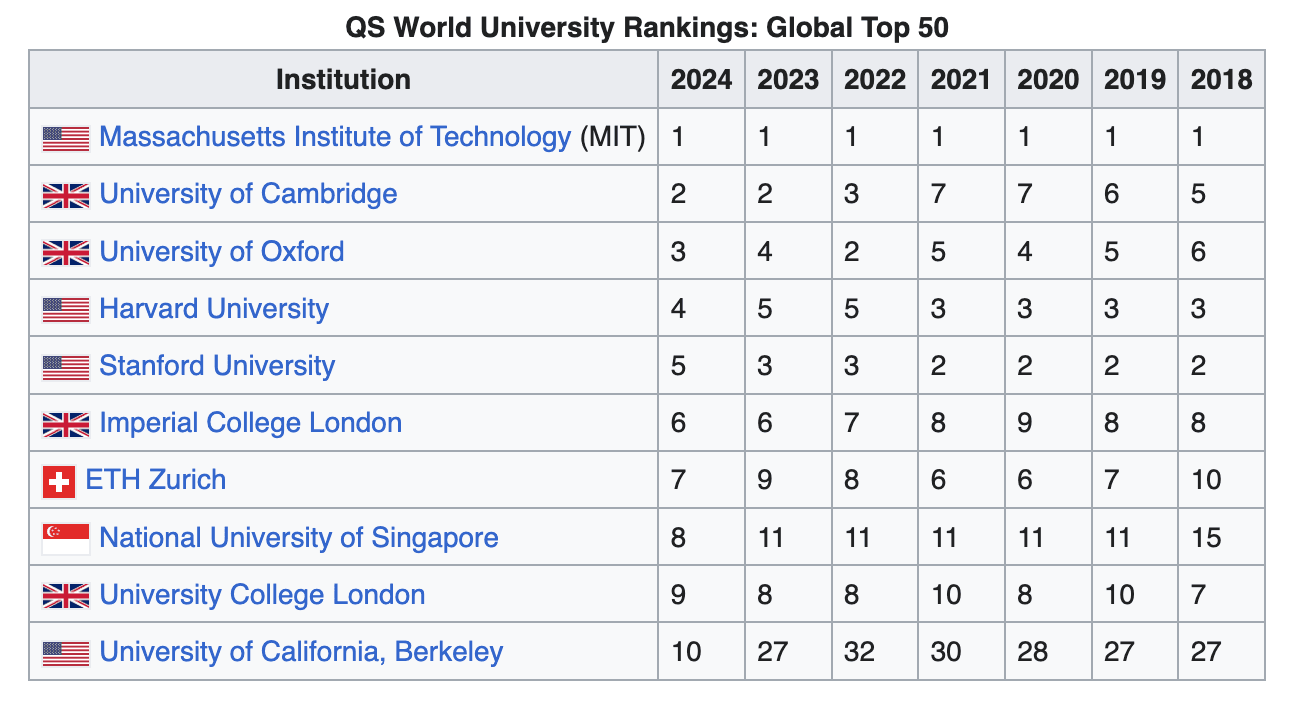

Europe is known for some of the best research in the world and the best talent. But Europe is not known for the best opportunities.

In all honesty, it’s so bad that by now Europe is considered a meme in the international startup ecosystem. Not a place that innovates, but that – at best – "only regulates". A place ambitious people "have to leave".

Don't believe me? Watch Eric Schmidt or Marc Andreeseen talk about Europe. It's so common as an opinion that many future founders in Europe start to believe it too.

To change this we need to create an environment where founders can succeed. If we want the innovation created in our universities to be brought to market by European instead of Americans we need to fix the root causes.

What's the root cause?

People mention ambition, bureaucracy, taxes and hundreds of other reasons. None of them are the true root cause.

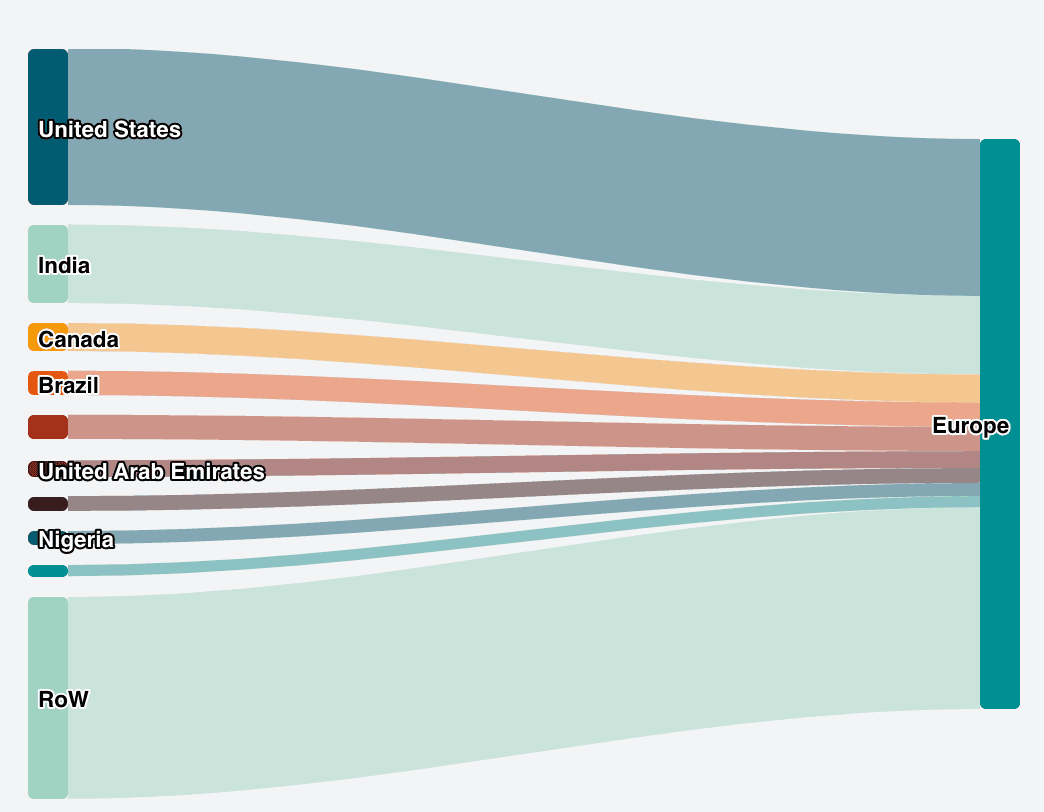

For startups, Europe’s main problem is fragmentation.

From consumer market, language, legal, education, taxes, to funding – Europe acts like a network of small countries instead of one unified market.

We don't need to become more American, we need to become more European.

The Euro is the proof that we can.

The Goal of this project is to…

Highlight excellence – to shift the discussion from negative memes to our impressive realities

Showcase the actual problems – to unify the narrative of our requests to policy makers

Suggest few and simple solutions – to allow policy makers picking efforts with high leverage

eu/acc – by European founders, for European founders.

Also @andreasklinger revolving credit options are common in the US but nonexistent in Europe. Comparison: with US finance options I am flush with options for biz line of credit, credit card.... In EU, the concept is, "deposit €30k, and we'll give you a credit line of €15k"

– Igore Foobar

Also @andreasklinger revolving credit options are common in the US but nonexistent in Europe. Comparison: with US finance options I am flush with options for biz line of credit, credit card.... In EU, the concept is, "deposit €30k, and we'll give you a credit line of €15k"

A standardized legal entity for Europe

In the US: As investor you receive an email to a website with a contract. You press a button. You just invested. You are done.

Standardization of legal entities (Delaware Inc), Documents (YC SAFE) and Software (AngelList, Carta, etc) made this possible.

In Europe a typical fundraising round might start with a ritualistic killing of a goat in front of a notary and – depending on the country – end in kneeling in front of local governments to summon paper documentation in time. You think we are joking… we wish i'd be that reliable and simple.

More importantly than being slow, complex, or traditionally middle-age procedures: It’s different in every little country.

So, countries with the population of a Chinese office building, or the GDP of an averagely successful computer game, have completely different processes, terms, expectations, constraints and legal dances an investor has to learn.

To expect that any European investor will learn this for 27 countries is absurd, to expect this from American investors is delusional.

To then complain that European startups does not have enough funding is hypocritical.

California is bigger than 23 of the EU countries, still all of Silicon Valley uses the Delaware Inc. Because standards in investment processes matter. This is where the ripple effects start.

You want to help founders in Europe to accelerate?

You want to support European Startups?

We need an European entity standard. Now.

Learn more about our working group

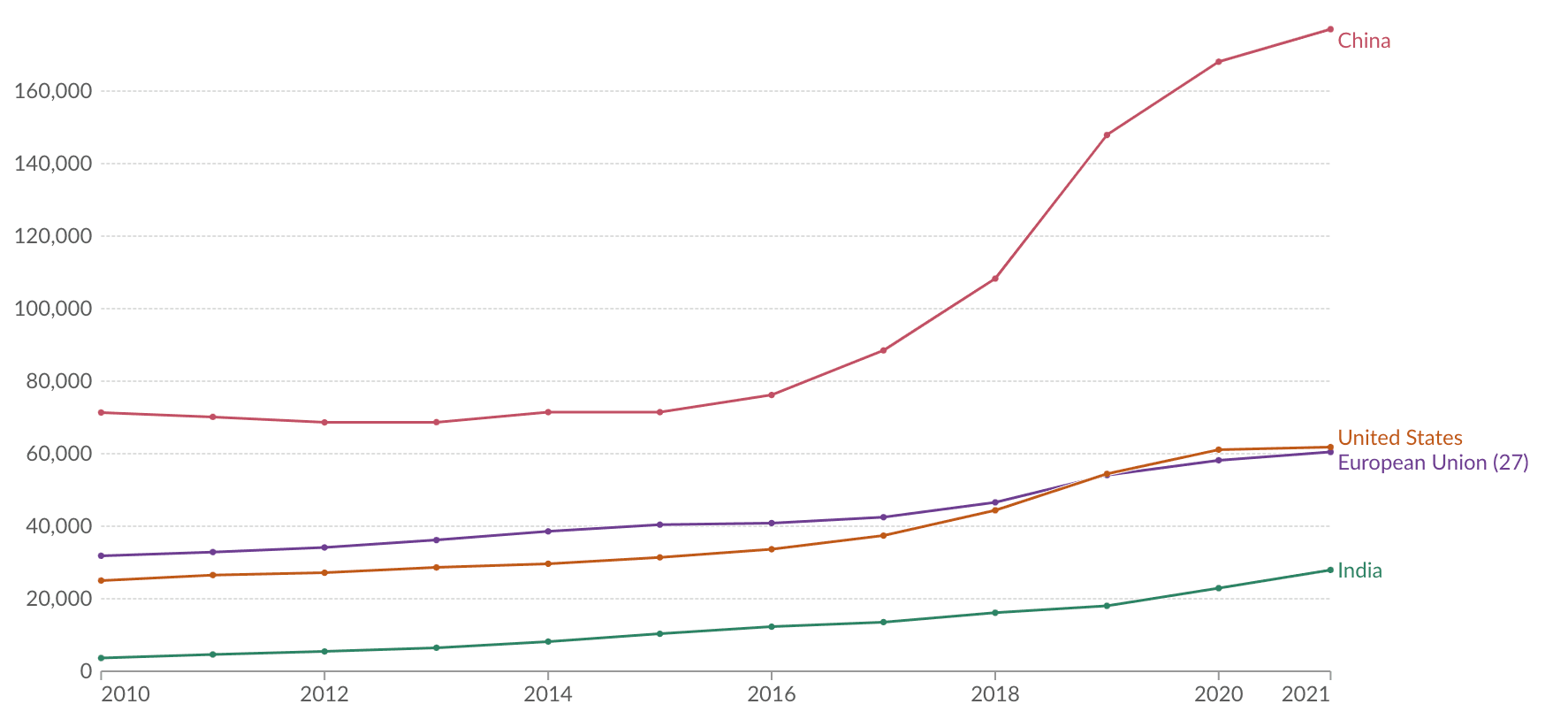

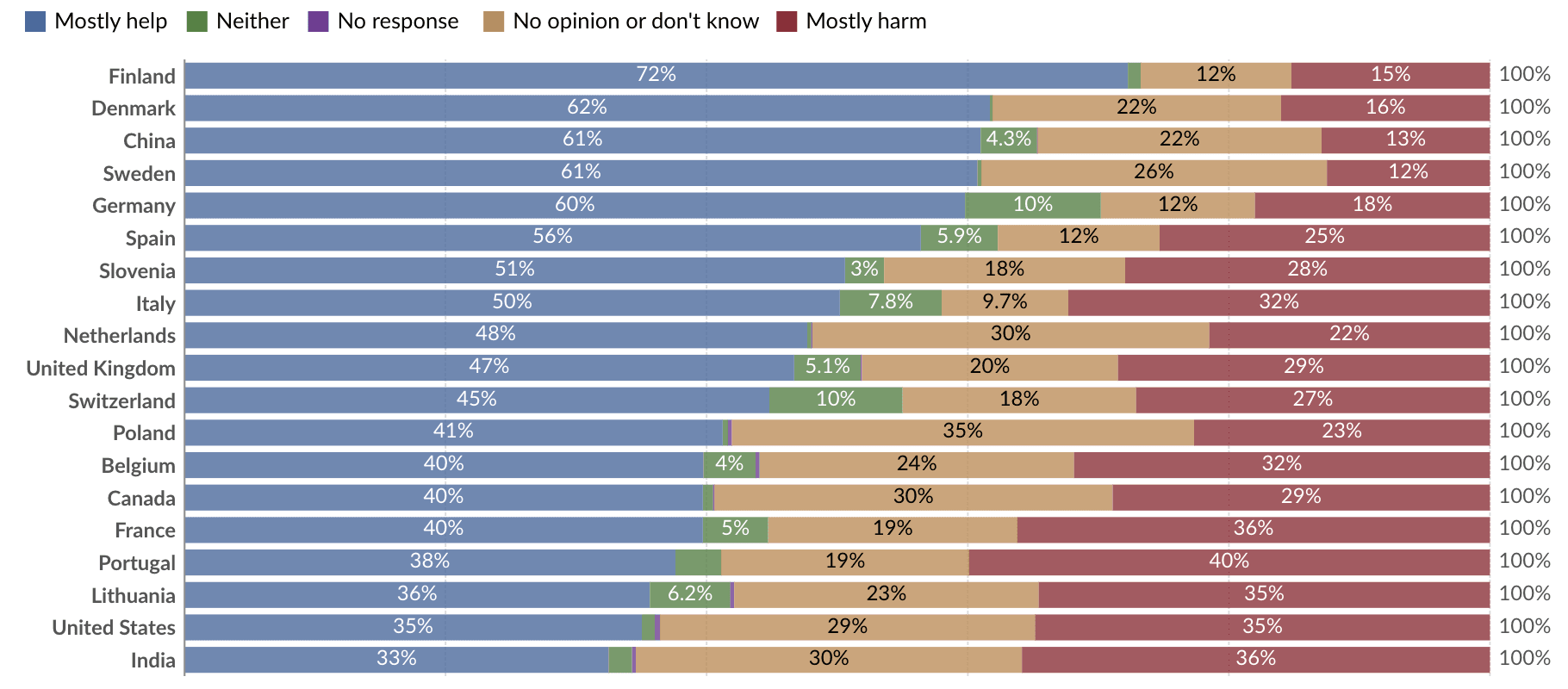

Europe is second only to China in AI research in absolute terms and second only to US in terms of population.

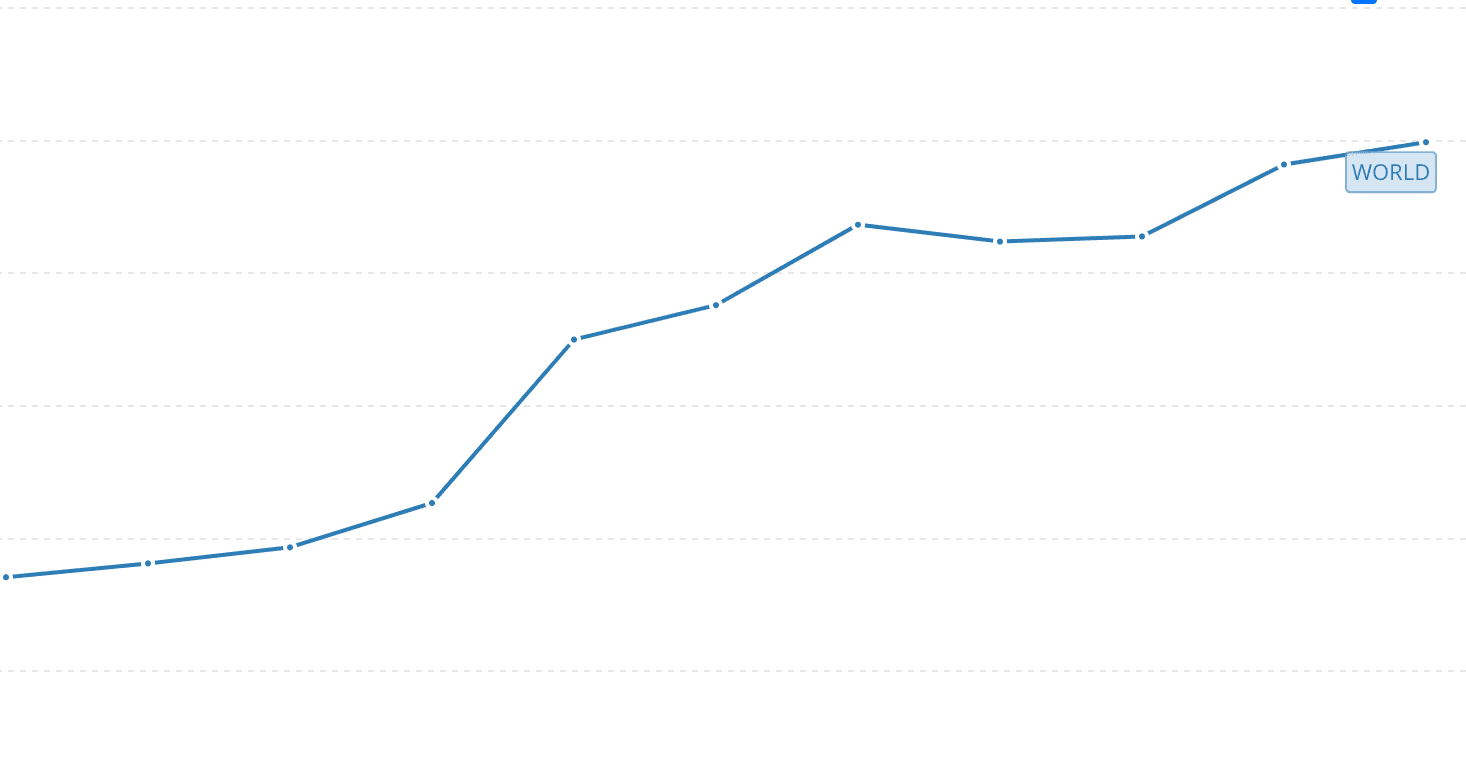

European countries have some of the highest rates of New Business Density in the world - most much higher than the USA for example.

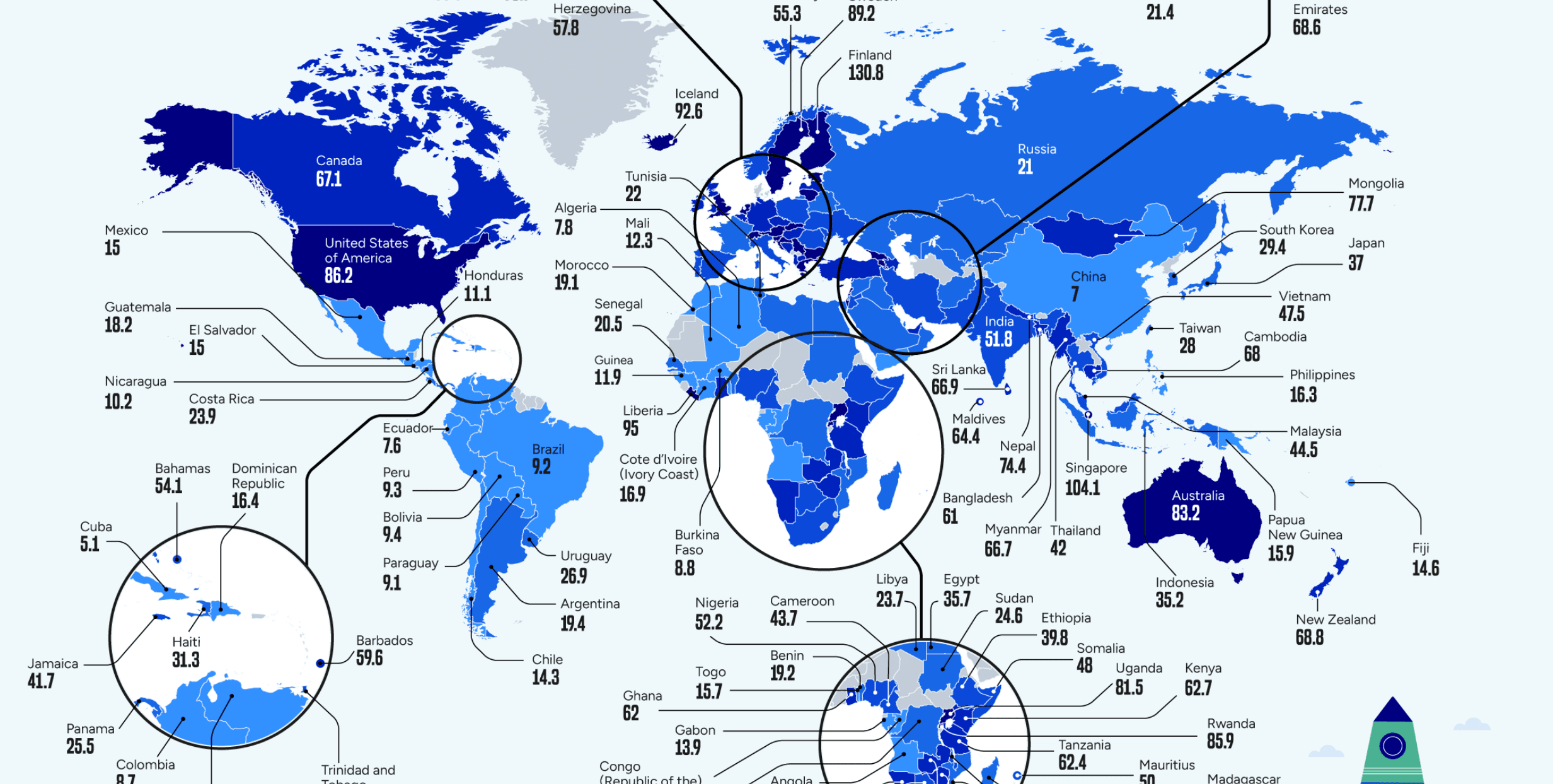

The European Single Market is the largest economic area in the world.

Europe is the world's largest exporter of manufactured goods and services, and is itself the biggest export market for around 80 countries. The average applied tariff for goods imported into the EU is very low. More than 70% of imports enter the EU at zero or reduced tariffs.

Got more? Please send them to us

/

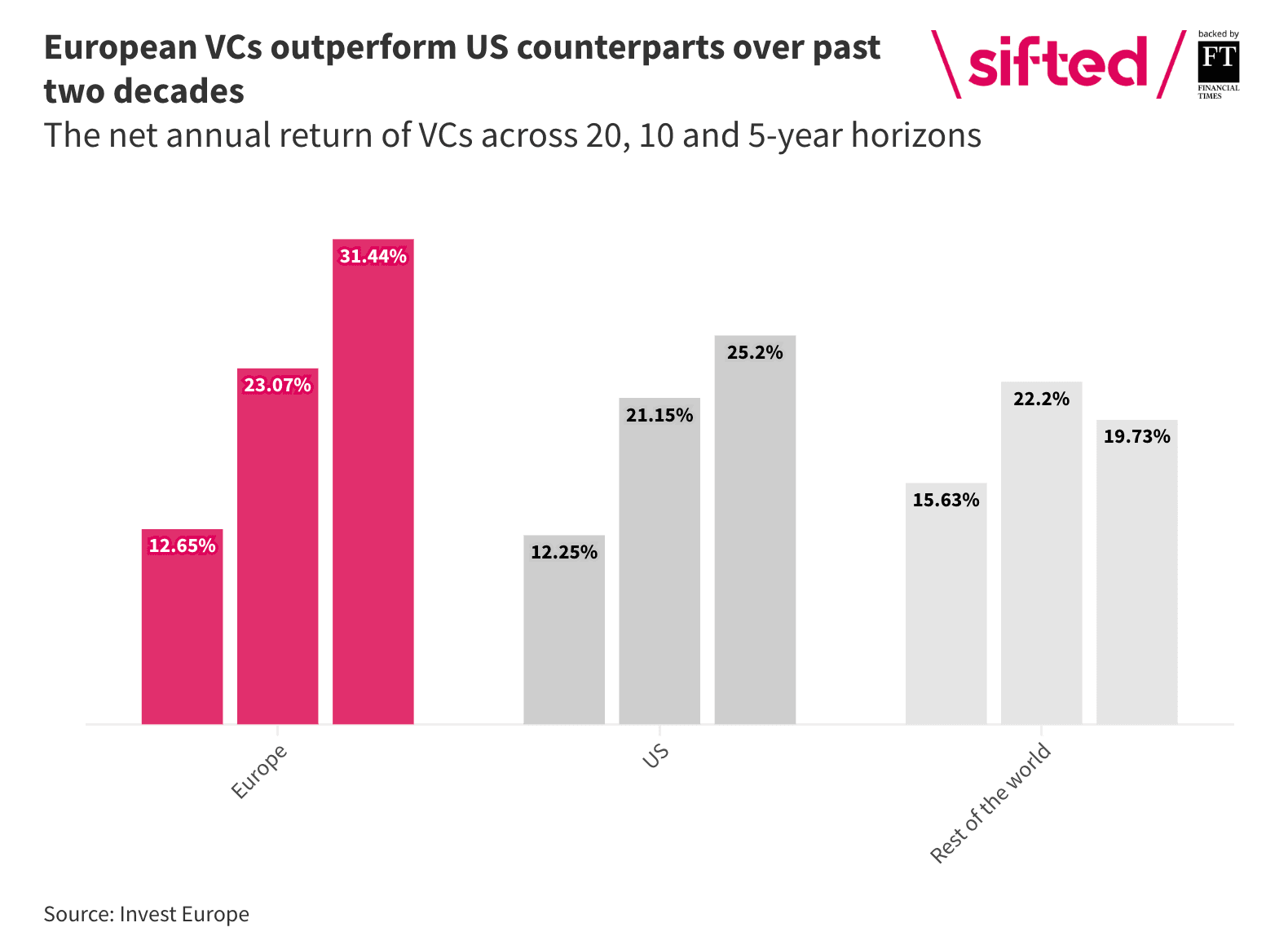

European Excellence

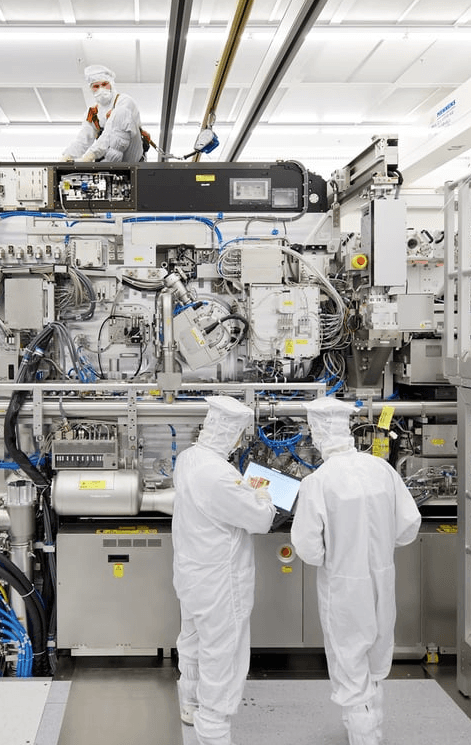

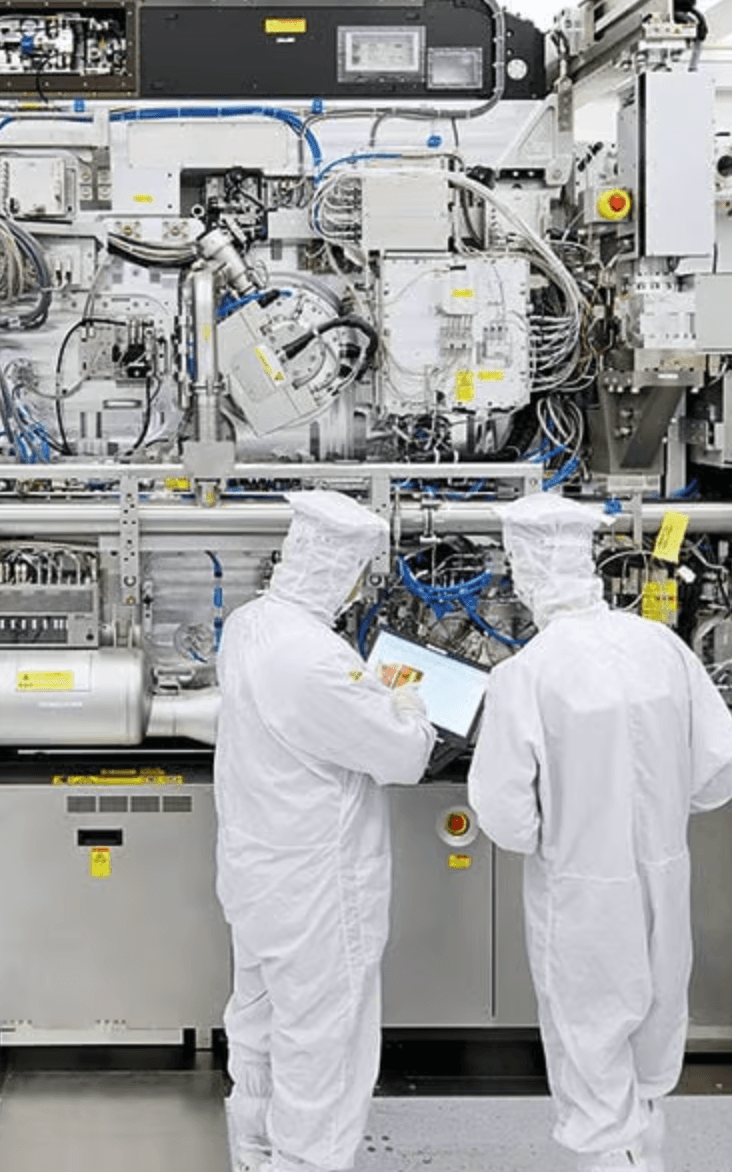

ASML

Lithography machines for semiconductor manufacturing. Only producer of EUV machines globally.

Netherlands | https://asml.com

test

Autonomous driving company.

Pioneered end-to-end robotics for self-driving cars.

Recently raised $1B in venture capital.

United Kingdom | https://wayve.ai

Hugging Face

The world's largest repository for machine learning models and hence de-facto standard.

France | https://huggingface.com

Exotec

Automated warehouse systems.

Known for Skypod system, with $1bn of revenue booked.

France | https://exotec.com

ASML

DeepMind

AI research laboratory with numerous AI breakthroughs. Acquired by Google.

United Kingdom | https://deepmind.google

1X Technologies

Humanoid robotics known for highest torque to weight drive servo motors.

Norway | https://1x.tech

Freque… come on you know what FAQ means.

There is no eu/acc without UK, Switzerland, Norway and co.

And success for Europe as a continent only works together as a whole. We are calling the movement eu/acc as a lot of the problems need to be solved at EU level.

A standard entity for european startups acts like a platform for further standardization. Investment documents will be one of them. Stock Options hopefully come soon after.

Our goal is not a centralized European government as this would be overreaching for this project.

They are lying. They are not for European Startups.

They are most likely optimizing for local gains and local political wins.

European startups cannot succeed if there are several dozens of different legal entities. There is no velocity without standardization. Everything else is just political powerplay.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Curabitur in ipsum massa. Mauris quis suscipit urna. Curabitur mollis, leo vitae lacinia cursus, nulla lacus porta urna, a viverra orci felis nec ante. Etiam cursus sodales ipsum, ut dignissim mi lacinia eget.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec id elit enim. Cras vel iaculis eros. Sed gravida euismod ipsum.